Fiscal Policy

Fiscal Policy

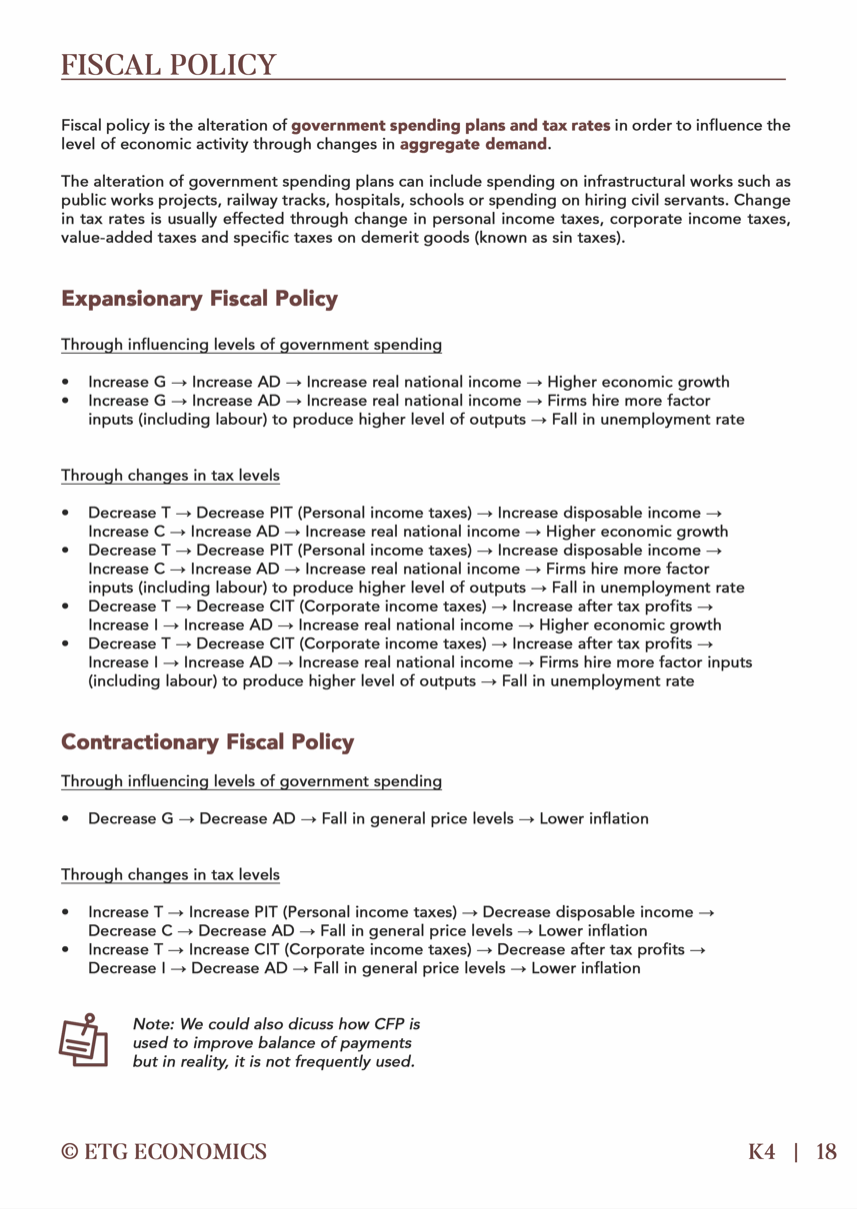

Discretionary fiscal policy are deliberate actions taken by the government to change the taxation and/or the level of government expenditure to influence aggregate demand to achieve macroeconomic objectives such as economic growth, price stability, and full employment.

Fiscal policy relies on two main tools:

Government Expenditure (G): This refers to all government spending on infrastructure, social programs, public services, and salaries for government employees. Higher G injects money into the economy, while lower G reduces circulating money.

Taxation (T): Taxes are levied on income, consumption, and other activities to generate revenue for the government. Lower T leaves more disposable income with consumers and businesses, while higher T reduces it.

Impact on Aggregate Demand

Fiscal policy influences economic activity by affecting Aggregate Demand (AD).

Expansionary Fiscal Policy: Aims to increase AD during recessions or periods of low growth.

Increased G:

Direct spending on infrastructure projects or public services creates jobs and boosts demand for related goods and services.

Transfer payments like unemployment benefits put money directly into consumers' pockets, increasing consumption spending.

Decreased T: Lower taxes leave consumers and businesses with more disposable income, encouraging them to spend and invest more. This is called the multiplier effect as the initial increase in spending ripples through the economy, generating further economic activity.

Contractionary Fiscal Policy: Aims to decrease economic activity (reduce inflationary pressures).

Decreased G: Lower government spending reduces money circulating in the economy, dampening demand for goods and services.

Increased T: Higher taxes reduce disposable income, leading to lower consumption and investment spending.

Impact on Living Standards

Fiscal policy can significantly affect living standards:

Economic Growth: Expansionary policy can promote economic growth, potentially leading to higher incomes and improved living standards. However, excessive deficits can hinder long-term growth due to rising interest rates and crowding-out effects (discussed later).

Income Distribution: Fiscal policy can be used to achieve a more equitable income distribution.

Progressive Taxation: This system taxes higher incomes at a greater rate than lower incomes, generating revenue to fund social programs and transfers that support lower-income individuals.

Targeted Transfers: These are direct payments to specific groups facing hardship, such as unemployment benefits or childcare subsidies.

Public Goods and Services: Government spending on public goods like education, healthcare, and infrastructure can improve quality of life, health outcomes, and economic opportunities in the long run.

Considerations for Singapore

Singapore's unique economic structure requires careful consideration when implementing fiscal policy:

Small Open Economy: Singapore is heavily reliant on international trade. Expansionary policies could lead to inflation if imports rise faster than domestic production. The Monetary Authority of Singapore (MAS) may need to counteract this through monetary policy adjustments.

Long-Term Sustainability: Maintaining a balanced budget or a small surplus helps ensure long-term fiscal sustainability. Excessive government debt can limit future spending flexibility and crowd out private investment.

Automatic Stabilizers: Some government programs act as automatic stabilizers, helping to moderate economic fluctuations. For example, unemployment benefits automatically increase during economic downturns, providing support to individuals and maintaining some level of consumer spending.

Evaluating Fiscal Policy

A comprehensive understanding of fiscal policy requires evaluating its effectiveness:

Effectiveness in Achieving Macroeconomic Goals: Consider time lags between policy implementation and its impact. Analyze the success of fiscal policy in achieving goals like economic growth, full employment, and price stability.

Impact on Income Distribution and Long-Term Growth: Evaluate how fiscal policy affects income inequality and long-term economic sustainability in Singapore's context. Consider potential crowding-out effects, where government borrowing might reduce available funds for private investment.

Conclusion

Discretionary fiscal policy remains a powerful tool for influencing economic activity and living standards. However, its effectiveness depends on various factors specific to an economy like Singapore. Understanding these nuances is crucial for analyzing and evaluating the role of fiscal policy in achieving national economic goals.

Did you know that Fiscal Policy is commonly tested in the A-Level CSQ and Essay? Are you confident that you can tackle them? If you aren’t, we are here to help:

The 2024 ETG June Holiday Intensive Crashcourse is your key to exam success.

What we offer:

Covering 8 crucial macroeconomics & microeconomics topics which are commonly tested in A Levels

Master a Massive Arsenal of Questions: We'll expose you to a wider variety of exam-style questions than you've ever seen.

Double the Practice, Double the Confidence: In just two intensive days, you'll tackle more essays and case studies than you probably have all year!

Unlock High-Scoring Answers: Learn the secrets to crafting top-notch evaluations that will impress examiners.

Structure Like a Pro: We'll equip you with the skills to dissect questions and write clear, well-structured essay responses.

This Crashcourse is the ultimate shortcut to A-Level Economics domination! Don't miss out - secure your spot today! Register for our Content Crashcourses and Essay & Case Study Bootcamp here!

Take a look at our stunningly curated textbooks, exclusively available for ETG students only:

Curious to find out about the ETG experience? Register for a Trial Lesson now! (P.S. There are free materials when you join for our Trial Lessons)